Some of the links on this site are Affiliate Links and if you use them to make a purchase, we may earn a commission. For more information, read our Disclosure Policy.

Do you often find yourself wondering how your money seems to vanish into thin air (even beyond the rate of inflation)? Or do you have a seemingly far-flung dream about being debt free? Then it is time to do something about it – and the best course of action is to set financial goals!

Unfortunately, you cannot just hope that money stays in your account or wish your debts away. You need to take command and set smart financial goals to accomplish these tasks.

Why is Setting Financial Goals Important?

Setting finance goals is the first step in gaining control over your money. By organizing your financial goals, you take the helm so that you know exactly where your money is spent (and where it is saved!).

While financial goal setting may seem simple enough, now more than ever, it takes immense effort and hard work to see it through. To help, I am sharing my 7-step plan for how to achieve financial goals.

What Are Basic Financial Goals?

Before we jump into the nitty gritty of conquering your goals of finance, let’s talk about what finance goals are.

What are financial goals? I define financial goals very simply. Finance goals are monetary targets or milestones.

You don’t need to be super savvy or hold a finance degree to set – or attain – finance goals. Anyone can set a financial goal; everyone should set financial goals. Whether you are rich and successful or frugal and cheap, setting goals is key.

There are two main types of Finance goals: Long-Term and Short-Term. Understanding the difference – and why they are both important – will help you set your finance goals.

Short-Term Financial Goals

Short-Term finance goals are – as the name suggests – goals that can be reached rather quickly, usually within a couple of months to a year. However, some goals can be reached in as little as one month – while others could take up to three years to accomplish.

Long-Term Financial Goals

Long-Term Finance goals, on the other hand, are grand goals that could take five years – or longer – to achieve. When individuals speak about long-term financial goals, they are often quite profound and lofty – and they likely require intense dedication.

Financial Goals: Examples

To help you better differentiate between the types of financial goals, we are going to look at some financial goal examples. This list of examples of financial goals is by no means exhaustive. Instead, I am highlighting some of the common financial goals – ones that may well be on your list of goals, too.

Short-Term Financial Goals Examples

These savings goals examples can typically be accomplished in less than a year.

Establish an Emergency Fund – A good goal for an emergency savings fund is three-to-six months of your average monthly expenditures…but $1,000 is a good place to start!

Set up a Sinking Fund – A sinking fund is a strategic way to save money by setting aside a little bit each month. I recommend setting up sinking funds in a high yield savings account. Learn more in my dedicated article to Sinking Fund Categories.

Paying Off Credit Card Debt – As a big believer in being debt-free, I feel strongly that paying off (or paying down) credit card debt is a good short-term goal.

Set Savings Goals Automatically – Getting automated is a great goal! Setting up a bank account and dictating a dollar amount or percentage of each paycheck to be automatically entered into it is a great way to kick off automatic savings that can be easily tracked.

Long-Term Financial Goals Examples

These long term financial goal examples could take 5 years or longer to accomplish.

Pay Off Student Loans – Based on your income and the amount of your student loan debt, paying off your student loans might be a long term financial goal.

Buy Real Estate – Buying real estate is often touted as one of the smart financial goals examples. When setting a long term goal of home buying, be sure to set short term goals – like increasing your credit score – along with it!

Invest Money for Retirement – It is never too early (or too late!) to get started and set a savings goal for your retirement. Sample financial goals would be to either save a specific dollar figure or save based on a target retirement age.

Eliminate All Debt and Live Debt-Free – Personally, I think this is one of the best financial goals to have! Eliminating all debt – credit card, car, college loans and mortgage – and living debt free is absolutely…freeing!

These are just a few examples of financial goals that are common for many people – perhaps, even you! Creating financial goals can help to get you on a path to better relationship with your money. That said, it is only one step in how to plan financial goals.

Setting Financial Goals in 7 Steps

Financial goal setting is a multi-step process that requires some grit and determination. My 7-Step plan for how to set financial goals helps to make the process as simple as possible!

#1 Figure Out What You Want

The very first step to setting good financial goals is to focus in on exactly what it is that you want. Think grand-scheme ideology. I want to learn how to save money better. I want to live a more minimalist lifestyle. I want to retire early. I want to be able to give more to charity.

Thinking outside the box and beyond dollar figures can help you better identify your financial goal.

Pro Tip: If you are creating financial goals for couples, then you both need to contribute to the entire process. I recommend starting here with #1, to ensure you are on the same page of your common savings goals from the get-go.

#2 Create Your Short-Term and Long-Term Goals

If this is the first time you have set personal financial goals, then perhaps begin with three short-term savings goals and one long-term goal.

Try to be as concise as possible; the more detailed, the more likely you will be to stick to it. Set goals that have trackable progress. If you can see success on your monthly financial goals, you can maintain a better focus.

Furthermore, set anticipated dates of accomplishing each goal. Without an end date, goals can easily be kicked down the road, into the future and into oblivion.

Pro Tip: More money is not the goal. Money is just paper; set your future financial goals on what the money will represent rather than solely on a dollar amount.

#3 Write It Down

One of the most important steps in how to make financial goals – and one that is often skipped over – is to write it down!

When we write down our specific financial goals, it helps to hold us accountable.

Create a Personal Financial Goals List and keep it somewhere where you will see it regularly – like your refrigerator door (along with your meal plan) or in your top desk drawer at work. You could even write your goal on a Post-it Note and stick it to your credit card so that you will be reminded of your goal anytime you are about to spend money.

You may even find success in making a Financial Resolution or using daily Positive Financial Affirmations. Try different techniques and figure out what works for you.

I would encourage you to take this one step further when setting money goals. Tell a friend. Tell the world. Shout it from the rooftops! When we declare our intentions, not only will we be more likely to follow through, but we can find allies and a support system to help us reach our goals.

Pro Tip: Additionally, schedule reminders to review your list of Frugal Goals. Keep your money goals top of mind.

#4 Make a Plan

Making a plan is the most difficult and uncomfortable step of setting a financial goal. In order to achieve the goals that you set, you will need a plan – and almost any plan to save money will require some changes (possibly extreme changes) in your spending habits.

You may also need to make a shift in how you think about money. In fact, I believe that it is impossible to reach long-term saving goals without somewhat altering your money mindset. It is all part of the process towards financial independence.

That said, you don’t need to be dire about making your detailed action plan. You just need to be willing to put in the effort and accepting of necessary changes…and a little enthusiasm won’t hurt either!

There are an array of action items that you can include in our budget plan. You can determinedly become frugal, take on extra hours at work, make more meals at home, or sell some of the underutilized things in your life.

You will need to analyze the best way to save for short-term goals, while keeping in mind your long-term goals, too. And, if you have entire family financial goals, you need to include everyone in the plan; one person can’t be left to do all the heavy lifting…it will never work.

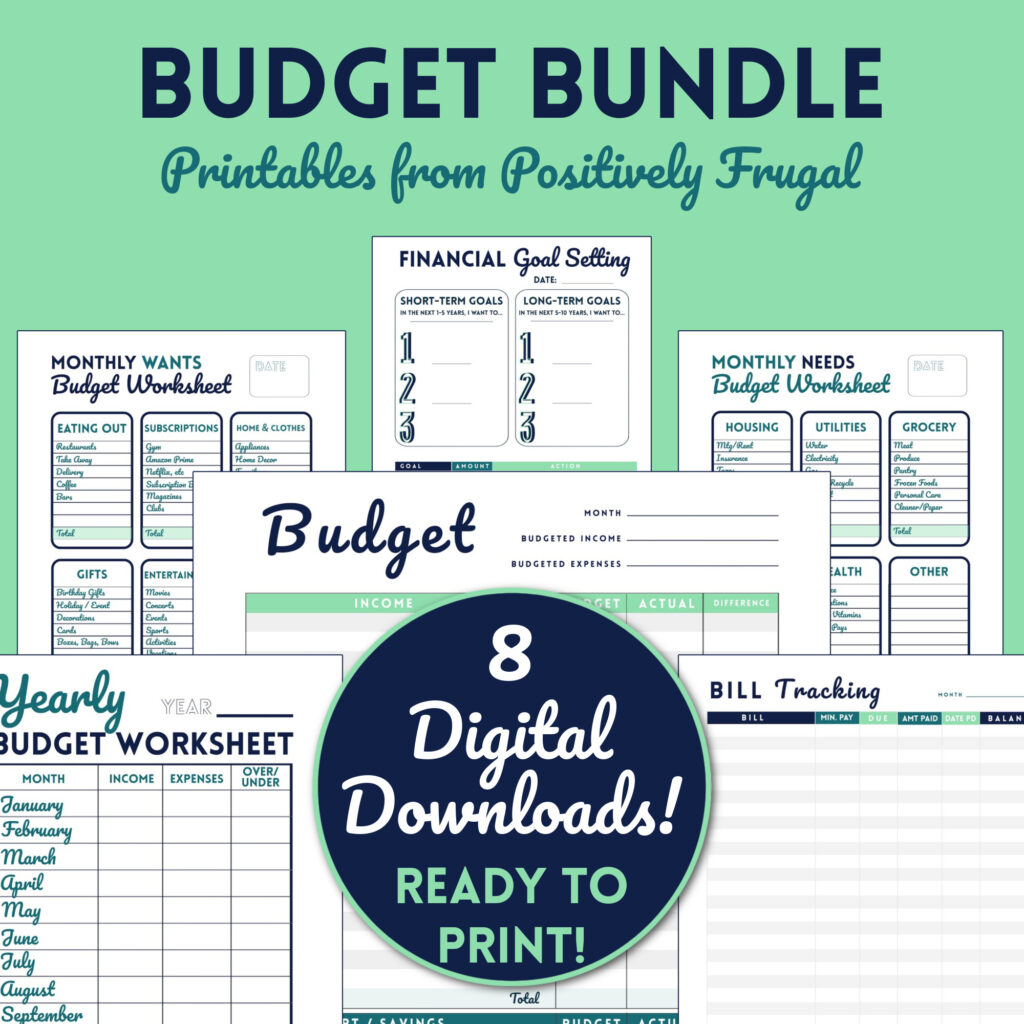

Pro Tip: It may be beneficial to invest in an inexpensive financial goal planner, like this one.

#5 Do The Math and Make a Budget

When you set personal finance goals you want to make sure the math works. Sometimes it can be difficult to really understand the numbers without seeing them – especially when it comes to money figures that often pass through our bank accounts and never in our hands.

I suggest getting out a calculator to do the math to make sure you are setting realistic savings goals that you can achieve in your specified timeline.

Once you have your numbers, plug them into your monthly budget. Creating a budget can help you reach a financial goal by allowing you to visually see what money is coming in…and where it is going out.

Need help with your monthly budget? You can use my blog post, How To Create A Budget.

Pro Tip: If you are new to budgeting and goal setting, it is much easier with templates! You can get a FREE budget template when you subscribe to the blog – but I also offer an incredibly affordable set of Budget Printables that includes templates for goal setting, budgeting and tracking!

#6 Track Your Progress

One of the key ways to ensure you stick to your financial goals in life is to keep track of your progress.

You can use a simple financial goal chart, online tools or apps. You can even create a custom Excel spreadsheet if that suits your style.

Tracking the progress toward your goals – both short- and long-term – will drive you to success. It does not matter how you track your goals, what is important is that it keeps you motivated toward achieving your finance goal.

Pro Tip: You can find a bundle of pre-designed Savings Trackers in my shop!

#7 Celebrate!

Achieving financial goals is reason to celebrate! When you reach financial goals – both big and small – mark it with a celebration.

Reward yourself for the hard work…then go back to the drawing board and make new finance goals.

Pro Tip: Make sure you budget for your celebrations – or find free things to do. Find inspiration for cheap ways to treat yourself in my article all about Cheap Rewards!

Tools for Setting Financial Goals

Now that you know how to set financial goals and achieve them, I have a few more tips for your financial plan success.

Financial Literacy: Educate Yourself

Accomplishing short term and long term financial goals is much easier when you understand money concepts and possess basic monetary skills. To become financially literate, you don’t need to earn a degree or even take a class. You can start by reading the Best Financial Books for Beginners.

Financial Journal: Track Your Progress

Regardless of whether you are tackling short term goals or 5 year financial goals, a journal or notebook can help you stay focused as you track your progress. Some people like an actual journal, but I prefer more flexibility, which is why I recommend using a binder.

In your Financial Binder, you can keep your list of financial goals, your monthly budget, credit cards and student loan debt payments, and your progress towards your goal. I provide useful worksheets in my Finance Bundle Kit.

Certified Financial Planner: Learn from a Pro

While individuals can plan their financial future on their own, consulting a professional for financial planning might help you attain your goals. You can talk to a professional financial planner about your financial goal list – including retirement goals, Roth IRA options, life insurance and wealth management.

Interested in more of my Budget and Goal Tips? I round them all up on the Budget & Goals page!

We Want To Know: What are your financial goals? What steps do you take to save money and make sure you achieve a frugal lifestyle? Tell us in the comments!

Pin It!