Some of the links on this site are Affiliate Links and if you use them to make a purchase, we may earn a commission. For more information, read our Disclosure Policy.

The first time I heard the term Sinking Funds, I didn’t think I wanted anything to do with them. Rather than questioning, What are sinking funds?, I automatically associated the word with something terrible. I suppose it is because the word Sinking made me think about the Titanic – and I certainly didn’t want to see any of my money slip through my fingers to the bottom of the sea.

As it turns out, I was wrong. So, so, so very wrong. A Sinking Fund is the exact opposite of what I thought it was. Money is not lost; it is saved – and it is saved in a simple and brilliant way.

When I finally learned the true definition of a Sinking Fund, it was a revelation. A light bulb popped on in my mind and illuminated how beneficial sinking funds are.

To clear up any misconceptions and apprehensions, I am going to cover everything you need to know about Sinking Funds – let’s call it, Sinking Funds for Beginners.

Not only am I going to define a Sinking Fund, but I’m highlighting a few examples of Sinking Funds and sharing ideas on the different types. Plus, at the end of the article, I provide a link where you can download a free Sinking Funds printable that you can use to get started saving right away!

What Are Sinking Funds?

If, like me, you are wondering – What is a Sinking Fund? – let’s clear the air and cover the definition.

Sinking Fund means saving money specifically for the payment of future debts. In corporate finance, this Sinking Fund meaning is often applied to companies that save specific money to repay investors.

So, what are Sinking Funds for personal finance? It’s essentially the same thing; it’s a person setting aside money to pay for something in the future. Another way to put it is to say that personal Sinking Funds are dedicated savings that are earmarked for something specific. It is a very direct and focused way of saving money.

Typically, people save Sinking Funds for big expenditures that don’t fit into normal monthly budgets – like new tires or a vacation.

The purpose of a Sinking Fund is to set money aside and save up for something so that you have cash for your expenditure when it is time to make the purchase. With Sinking Funds, you don’t need to go into debt using credit cards or take out personal loans…which means you won’t have to worry about interest rates.

Sinking Funds Definition

According to Investopedia, “A sinking fund is a fund containing money set aside or saved to pay off a debt or bond.” This definition covers the general idea, but relates more to the corporate finance term.

The meaning of sinking fund as it applies to personal finance is best defined by Dave Ramsey, author of The Total Money Makeover, who says, “A sinking fund is a strategic way to save money by setting aside a little bit each month.”

How Do Sinking Funds Work?

How Sinking Funds work is that it forces you to consider the things you want or need to buy in the future – and you start planning and saving for them in advance. This way, you aren’t caught off guard without the funds or the need to rack up credit card debt.

Although we live in a “Buy Now, Pay Later” society, debt is detrimental to your overall financial health (which is why I preach the benefits of being debt free!). Sinking Funds will actually help you keep your head above water and encourage you to save before you spend.

Sinking funds work best by following a 3-step process.

Step #1: Goal Setting

First, you need to Set a Goal. Determine what you are saving up for. It can be a need or a want. Once you have your goal, figure out how much money it will take to pay for it.

Step #2: Budget for Your Goal

Next, you will do a little math. Calculate how much – at a minimum – will you need to save each week or month in order to have enough money to reach your goal.

Sinking Funds become a line item on your personal budget. If you haven’t made a budget before, you can get started with my tips on How To Make a Budget.

Step #3: Start Saving Money

Typically, saving money is the hardest part. But that is the beauty of Sinking Funds; saving money is actually fun!

As you save each week or month, you can watch your progress and see your savings grow. Each time you deposit money toward your goal, you will feel motivated to succeed.

The money you save is then specifically spent on the item or experience that you saved the money for. You have the cash to cover the complete cost, rather than using a credit card, going into debt and paying interest.

How Are Sinking Funds Different from Other Savings Accounts?

Sinking Funds are unique. They differ from a traditional personal savings account in that they are hyper-focused. It’s not a slush fund or rainy-day fund or even a get-ahead fund. It is not a fund for random, unexpected expenses. The Sinking Fund is assigned a specific goal and saving for the goal is intentional.

Benefits of Saving with Sinking Funds

Saving with Sinking Funds has so many incredible benefits – from organization to enjoyment! Adapting to the mindset can even help you reshape your thinking about your overall spending and possibly promote a positive change in your relationship with money. I’m highlighting a few of the main benefits of opening a Sinking Fund account.

Stay Organized

One of the top benefits of Sinking Funds is that it helps you stay organized with your finances. There is no more wondering where all your money went. By purposefully saving your funds, you know exactly where your money is – and what you intend to spend it on!

Pay Zero Interest

Perhaps the greatest benefit of a Sinking Fund is that there are no extra fees and zero interest associated with the savings method. The price you pay at the register is the final price…not the price plus interest.

No one wants to pay more for something than they have to. Yet, every time you make credit card purchases and let a balance sit on your credit card, you are paying interest. That interest is adding more cost to every single one of the items you purchased. Really think about that for a minute.

Stop Dipping into Other Savings

When you plan ahead and save with Sinking Funds, you can leave the rest of your savings – your emergency fund, retirement account and personal savings – intact.

With a clear plan and strategy for saving up for a particular thing, you won’t need to dip into your other savings accounts.

Save, Pay Off Debt and Get Ahead

The brilliance of Sinking Funds is that by planning ahead and saving over time, you can continue paying off credit cards – plus add to your other savings simultaneously.

This is where a good budget really comes in handy. By adding Sinking Funds as a line item to your budget, you can see where to stretch, what to cut and how to direct every last cent of your paycheck to make it all work.

Side Note: Debt Payoff Trackers can help you on your road to paying off credit cards for good!

More Time To Research

Have you ever been burned by impulse buys? I know I have! Not only can impulse buys put a dent in your budget, but they often fall short of expectations and leave you with buyer’s remorse.

Sinking Funds, however, are designed to encourage saving over a longer timeframe. During the time it takes for you to save up enough money for your goal, you can be researching your future purchase so that you are certain to get the most bang for your buck.

Keep Your Eye on the Prize

Sinking Funds are motivating! When you set a goal and build up savings to reach that goal, you can visibly see your progress, which will help keep your eye on the prize.

Visual representations – like a printable worksheet – will assist in keeping your focus on your final goal. I cover Sinking Funds Trackers more in a minute!

Need more motivation? Use my Tips for Reaching Money Goals!

Help Control Your Spending

Even if you are not a big spender, you are likely spending more money than you need to – and maybe even more than you realize.

Goal-oriented Sinking Funds can help you control your unfavorable spending habits and ultimately help you to become more frugal. With your goal top of mind, you will actually want to stop spending money because you will want to be saving more!

Enjoy Your Purchase

One of the top benefits of Sinking Funds is that when you finally do make your purchase, you are complete free to enjoy it! Your purchase will not be associated with guilt or remorse.

Instead of wondering how you are going to pay off the birthday party you just threw, you are content that it’s already been paid for up front. You saved for it, now go enjoy it!

Types of Sinking Fund Savings

In personal finance, there are three Sinking Funds types: Short-Term, Long-Term and Revolving.

Short-term Sinking Funds are savings goals that can be achieved within 3-6 months. They tend to be lower-priced items – but don’t have to be. With short-term Sinking Funds, you can achieve success and get your reward in a short amount of time.

Long-term funds are bigger ticket item – like a new-to-you car or an extravagant vacation. Long-term Sinking Funds can take a year, two years or longer to achieve.

Revolving Sinking Funds are continuous. You regularly deposit and withdraw funds – such as with a Pet Care fund or Dining Out fund. You still save the same way for Revolving Funds, but rather than completely draining the account, you only use the amount you need…and then keep saving. And, if the funds fall to a zero balance, then you commit to not spending any money on that category until you replenish the account.

Sinking Fund Examples

To better help you better visualize the idea, I’m sharing a few Sinking Funds examples so that you can imagine how you can start implementing the strategy.

Christmas Sinking Fund Example

Christmas happens at the same time every single year. Yet, as December rolls around, we find ourselves scrambling for cash and stressed out about how we are going to afford presents. Worrying can ruin the holidays – but not if you have a Christmas Sinking Fund!

Even with a short-term Sinking Fund, you can get ahead of the game.

According to the National Retail Federation, Americans spent on average about $1000 celebrating Christmas in 2020 – including everything from gifts to decorations. With that $1000 figure in mind, let’s set up a Christmas Sinking Fund.

Let’s start our fund in June – that is 6 months before the Christmas holiday. With 6 months to save $1000, we need to set aside $167 per month – or $38.50 per week.

If we meet our goal each and every month, we will have the money to cover our Christmas Gifts. Come December 25th, you will be on budget, relaxed and feeling very merry!

House Down Payment Sinking Funds Example

Buying your first house is an exciting adventure…but it’s also expensive. Purchasing a house is a big investment – and the bank lender requires a down payment. Most banks ask borrowers to put down 6% of the loan value. On a $225,000 loan, a 6% down payment is equal to $13,500. That’s a solid sum of money on most any budget.

Setting up a long-term Sinking Fund is an excellent way to save money for a down payment on your new house. When you plan for your future, the earlier you start, the easier it is.

For example, if you start your House Fund one year in advance of your purchase, you will need to save $1,125 for 12 months before you reach your goal.

If, however, you set up your Sinking Fund over a two-year period, the amount you need to put into your House Fund each month is only $562.50. And, if you really plan in advance – and start saving 3 years before you buy – you only need to set aside $375 per month to achieve your goal.

The longer you plan, the easier it is to save!

Eating Out Fund Example

When I started budgeting, eating out was one of the first things I slashed from my expenditures. I was just learning about how to be frugal with food and it was clear that the cost of dining out was exorbitant compared to cooking and preparing my own food at home.

However, once we got our family finances in order, we decided to start budgeting for eating meals out. Creating an Eating Out Fund is an ideal way to still have fun dining out experiences while keeping the budget in check.

A fund for eating out is an example of a Sinking Fund that is revolving. You constantly add to your running total…and only spend when you have enough saved up to do so.

How it works is that you come up with an amount that you are comfortable saving each month. For this example, let’s say that you can comfortably save $100 a month to be used at restaurants.

Each month, you sock away $100 into your Eating Out Sinking Fund. This month, you eat out three times, each time spending $25 for a monthly total of $75, leaving $25 in your Sinking Funds account.

The next month, you add your $100 to the $25 from the previous month for a total of $125. During that month, you only go out twice, spending $50 total and leaving a remainder of $75 in the account.

The following month, you add your $100 – so a total of $175 is now in the account. You go out for a nice dinner – a cost of $50 – and then get busy at work an end up eating out five times – $25 each time – that month. The monthly total spent at restaurants is $175, which zeros out the Eating Out Fund. You don’t eat out for the rest of the month, because you don’t have any funds saved. The next month you refill your account with a fresh $100. It goes on this way continuously.

Sinking Funds Ideas

What I really love about Sinking Funds is that you can use them for almost anything! You can be as specific or general as you would like to be.

Furthermore, you can have as many Sinking Funds as you want. With numerous Sinking Funds, you can be intentionally saving for multiple things at one time.

Common ideas for Sinking Funds are:

- Emergency Funds

- Vacation Fund

- Car Repairs Fund

- Pet Care Fund

- Entertainment Fund

- Clothes Fund

- Medial Fund

- House Upgrades Fund

- Wedding Fund

- College Fund

Find more details and information in my article, Sinking Fund Categories!

How to Calculate a Sinking Fund

You don’t need a fancy Sinking Fund Calculator do the accounting for Sinking Funds that are part of your personal finance. It’s a simple formula that is easy to calculate.

Formula of Sinking Fund Based on Goal and Time

To do the calculation of Sinking Funds, divide the total amount of money needed for your goal by the total number of weeks or months until you need or want to make your purchase.

GOAL $ AMOUNT ÷ # OF MONTHS (OR WEEKS) = AMOUNT TO SAVE EACH MONTH (OR WEEK)

Now, let’s put this Sinking Fund calculation into a real life example. Let’s say that you know need new tires for your car in time for the upcoming winter. They will cost $600. It’s March, so you have 7 months until you need the new tires on your car.

To figure out how much you need to save each month, divide 600 by 7. If you are saving weekly, divide 600 by 28.

$600 ÷ 7 months (or 28 weeks) = $85.75 per month (or $21.50 per week)

How To Calculate Sinking Fund Based on How Much You Can Afford

Alternatively, you can calculate Sinking Funds in reverse – based on how much you can afford to save each month. This is especially useful if your goal is a want, not a need.

GOAL $ AMOUNT ÷ MONTHLY SAVING AMOUNT = # OF MONTHS TO REACH GOAL

Now let’s use a real life example of Sinking Fund for something that you want – for instance, a new guitar. The guitar costs $450 and you can manage to put aside $20 a week (or $80 per month). Take the total amount of money needed to reach your goal – $450 – and divide it by 80. This equation will tell you how many months it will take to reach your goal.

$450 ÷ $20 per week (or $80 per month) = 22.5 weeks (or roughly 5.5 months)

How To Set Up Sinking Funds

Once you set your goal and determine how much money you need, you will need to decide where you want to save your cash.

How to organize sinking funds will depend on your preference and the amount you want to save. That said, it is best to use separate accounting for each of your Sinking Funds. You don’t want the funds to be comingling.

A savings jar at home is a good way to save up for small savings goals that are $200 or less. For instance, a savings jar is perfect for a revolving Coffee Fund.

Another way to save cash at home is using Sinking Funds Envelopes. A different envelope is used for each fund. Then, every month, you disperse the minimum amount of cash into each envelope.

I like the money envelope method because it is tangible and you can really watch your savings increase. However, it can also be really tempting to use the cash for something else. Plus, if you are saving large sums of money, it is probably better to keep it in a bank.

Sinking Fund Bank Accounts

Setting up separate bank accounts is my favorite method of savings for Sinking Funds. With my bank, I can set up multiple accounts and link them together. That way, I can electronically disperse funds from my primary account to each of my funds. With just a few clicks, I manage my Sinking Funds.

There are some things to think about before you set up your accounts. First, find out if there is a fee for operating the accounts. Sometimes checking accounts are free, while savings accounts accrue a monthly fee. Second, ask if there is a minimum amount required to be kept in the account – otherwise, you might get hit with fees.

A money market account can be a good type of account for your Sinking Fund, too. Money Market accounts typically have higher interest rates, however, some require a higher minimum balance. Check with your bank to find out your options.

If your bank does not provide reasonable services, you might want to check out the suggestions for best accounts for Sinking Funds by Nerd Wallet.

Furthermore, if you find that the temptation to spend money – even though they are in separate accounts – is too great, then consider using different banks for different funds. I would not recommend doing this for too many accounts, but keeping a fund, like your Emergency Fund, completely separate is not a bad idea. Again, use the article above to help you find the best bank for Sinking Funds.

Sinking Funds Budget: How To Fund Your Fund

The key component to making Sinkings Funds work is finding money to save.

In many cases, you will just need to learn how to shift your money around in your budget. Find obvious places where you can cut unnecessary monthly expenses so that you can start saving for what you really want.

Once you pinpoint where you are overspending, you can make adjustments – like finding new ways to buy groceries on a budget or adapting to a more frugal lifestyle.

If you are already stretched thin, then you might have to get creative. You can find ideas for extreme ways to save in my blog post, Extreme Frugality. Some of my tips can literally save you hundreds!

Whether you are just making a little room in your budget or need to make significant cuts, you can stay motivated with Savings Games and by tracking your funds.

How to Track Sinking Funds

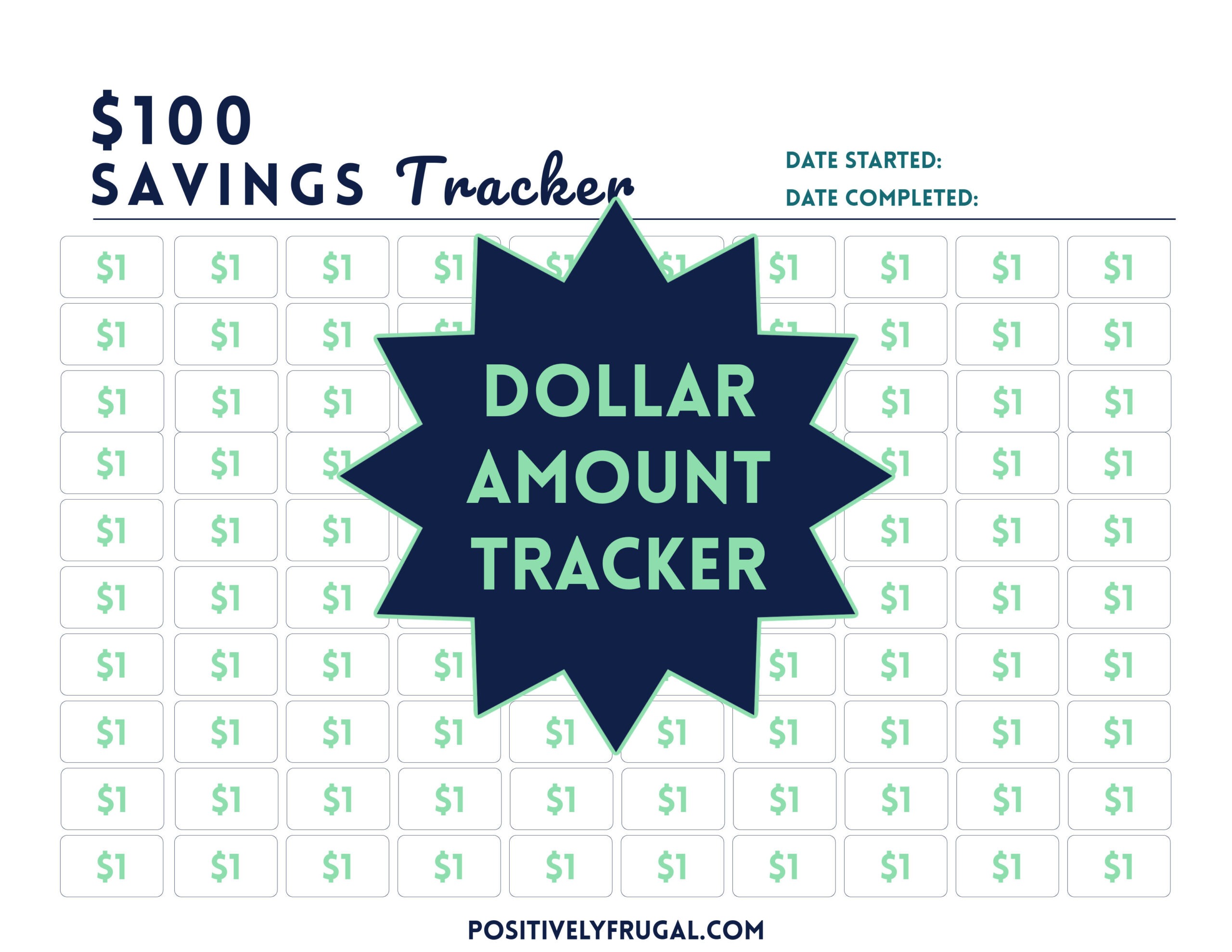

Now that you know what you are saving for, where to save and how to save, it’s time for the best part: watching your fund grow! Of course, you can just periodically check that balance in your Sinking Funds bank account or count the cash in your envelope, but it is so much more fun to have a tracker!

Sinking Funds Tracker

Tracking savings will keep you motivated and engaged with your goal. There are two common types of trackers: Spreadsheets and Charts.

Sinking Funds Spreadsheet

If you have a mathematical mind, then a spreadsheet for Sinking Funds is a good tool to visually see the overall numbers in black and white.

With a basic spreadsheet, you keep track of monthly deposits and your running balance. The spreadsheet can be printed and completed with a writing utensil or set up digitally in Excel or a similar program.

Sinking Funds Chart

A chart for Sinking Funds is usually more artistic and is a visual representation of your savings rather than the actual numbers.

To use a Sinking Funds worksheet, you typically fill in the spaces using colored pencils. The more colorful your page is, the bigger your account is getting. When all the spaces are filled, you have reached your goal!

I include both types of trackers in my Savings Trackers Bundle!

Free Sinking Fund Printable

One of the top benefits of a Sinking Funds printable is that you can watch your progress and, ultimately, achieve success.

Because I want you to succeed, I’m giving you a FREE printable Sinking Funds tracker. You can start your savings RIGHT NOW when you download my Sinking Funds PDF.

We Want To Know: What do you use Sinking Funds for? What tips do you have for success? Share your ideas in the comments below!

Interested in more of my Budget and Goal Tips? I round them all up on the Budget & Goals page!