Some of the links on this site are Affiliate Links and if you use them to make a purchase, we may earn a commission. For more information, read our Disclosure Policy.

Tracking savings is a fun way to watch your money grow – especially when you are trying to save up for something big. A Savings Tracker can be a key component to sticking with your goal and attaining success!

To help you reach your target, I am offering a free savings tracker that can be customized to your personal saving goals. You can claim Your FREE Printable Savings Tracker at the end of the article – but first, let’s cover the basics.

What Is a Savings Tracker?

It’s really quite straightforward. A money saving tracker is a worksheet that you use to keep track of your savings.

There are hundreds of different kinds of savings trackers. Saving trackers can be simple sketches or elaborate illustrations. They can be general or themed savings trackers.

Typically, saving tracker worksheets are completed by coloring in sections as you reach your savings goals. When all of the sections are colored in, you have attained your objective.

The visual representation of your growing savings will help encourage you to keep saving so that you will reach your ultimate goal.

Pro Tip: A savings tracker is a good way to organize your savings – but getting organized with your overall financial situation is essential!

What Type of Savings Should I Use a Savings Tracker For?

A financial savings tracker can be used for any kind of savings – from personal savings to emergency funds to retirement goals.

That said, because savings trackers are focused on a specific goal, they work best for Sinking Funds.

What Are Sinking Funds?

Sinking Funds are specific savings set aside for a single expenditure. Some examples of Sinking Funds are a Vacation Fund, Christmas gift money or savings for house upgrades.

With Sinking Funds, you are saving with a purpose. Therefore, saving trackers are ideal for Sinking Funds, as you can keep an eye on your progress.

Pro Tip: Read my complete Guide To Sinking Funds and Sinking Fund Categories!

What are the Benefits of Tracking Savings?

Money trackers are not just fun ways to track your savings – they have many other benefits, too!

Helps You Make Realistic Goals that You Can Attain

Goal setting can be scary and, oftentimes, overwhelming. Some goals seem so big that they feel impossible to reach. Saving money goals that are left undefined and untracked risk never being achieved.

With a financial money tracker, however, you define exactly what it is that you desire. It makes your goals more realistic – and you will see the steps required to attain that goal. In my opinion, a visual saving money tracker is the best way to track goals – both big and small.

Maintain Focus on Your Goal

When it comes to goals, one of the biggest downfalls is the lack of focus and commitment. If you don’t have your goals in clear sight, you are a lot less likely to hit your target.

A savings tracker helps you to maintain a laser-like focus and stay wholly committed to your goal. You are more likely to reach your money goals by using even the simplest money tracker.

Your Progress Will Propel You

In almost all aspects of life, watching your progress will help propel you towards great things. It’s true with saving money, too – and a savings tracker will help.

Completing your saving tracker worksheet offers a tangible way to follow your progress. Each time you move forward and complete a new section, it represents a small win.

As you get closer to your goal, you will notice a shift in your perspective. You may even experience a change in your relationship with money – which can help you aim toward bigger and better future financial goals, too!

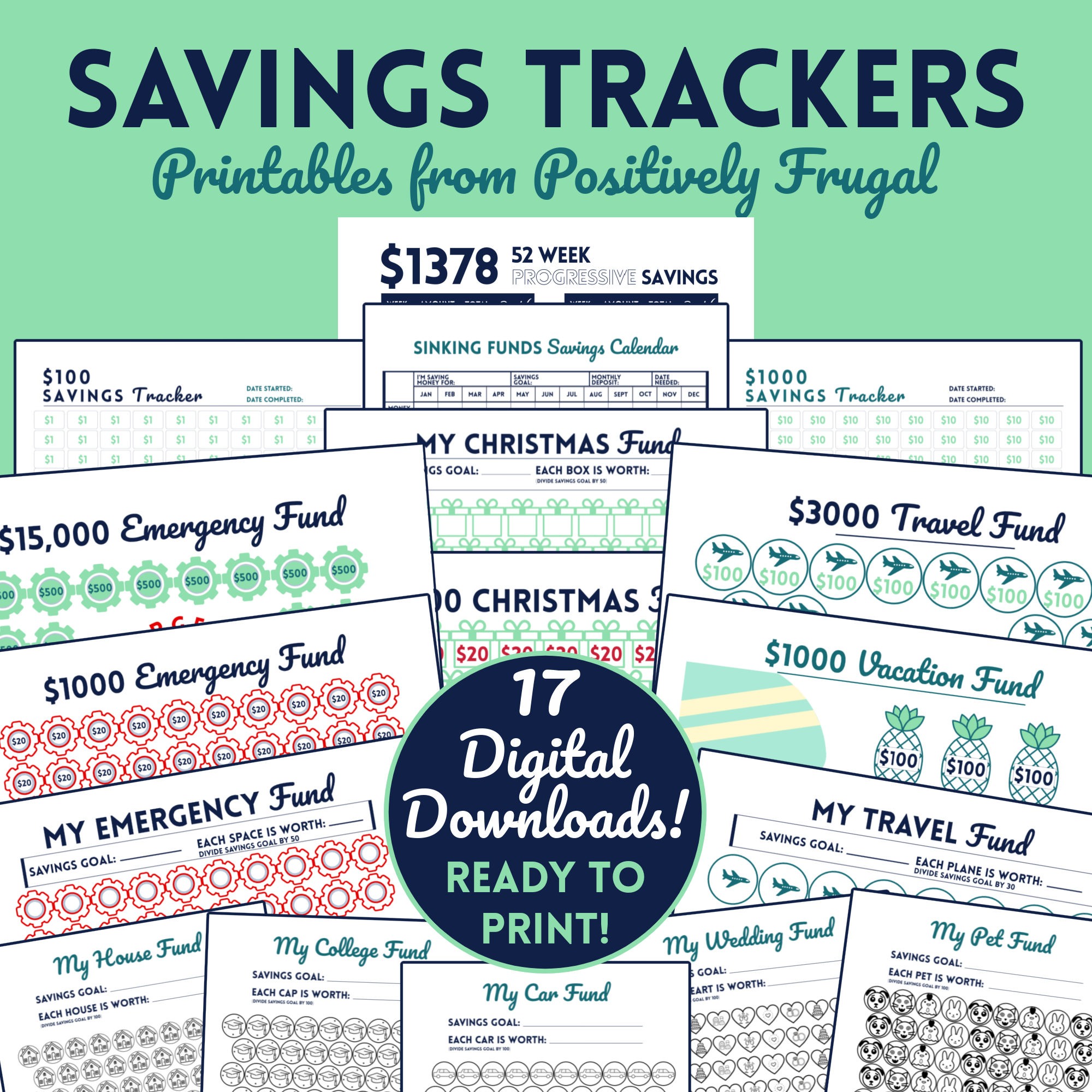

What Are Some Examples of Savings Trackers?

There is not one tried-and-true printable savings tracker that will work for everyone…and you need to find the one that works best for you.

To help you get an idea of the various savings trackers available, I’m sharing a few of the most popular worksheets.

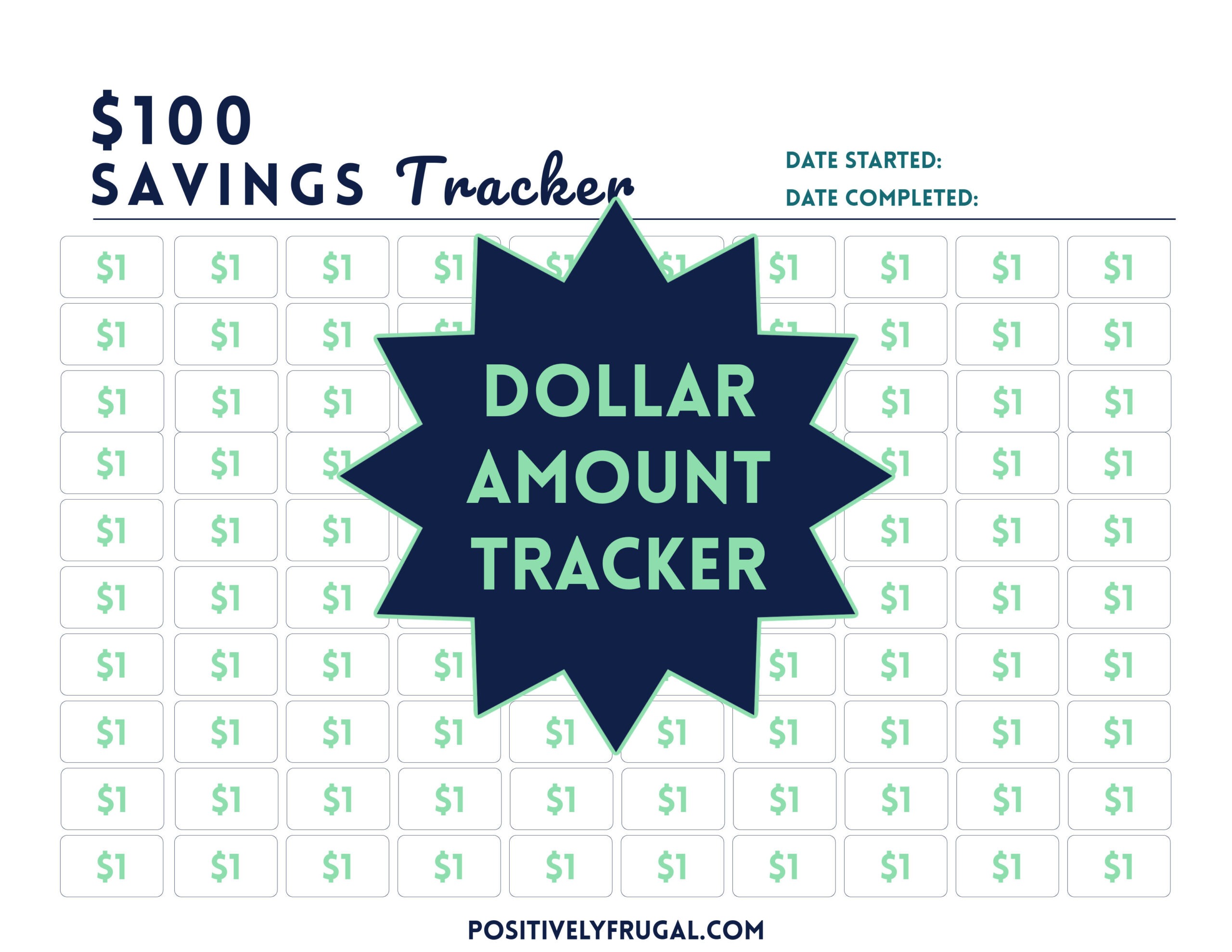

Dollar Amount Visual Savings Tracker

A basic Dollar Amount financial goal tracker is fantastic for beginner savers. The simplicity makes it versatile. Whether you are saving for a new set of tires or a prom dress, a Dollar Amount Worksheet offers a clear and concise path to success.

With a pre-made $100 or $1000 savings tracker, you can print as many sheets as needed to reach your goal.

52-Week Savings Tracker Printable

The 52 Week Challenge savings worksheet is a yearly savings tracker. It differs from other savings tracking tools in that it gives a structured timeline and savings schedule. With a 52-Week Money savings sheet, you are motivated to save $1,378 over the period of 1 year.

Not only will the 52 weeks of savings yield a nice little pile of cash, but it also promotes the routine act of saving money. Once you get into the habit of saving, future saving becomes so much easier.

Emergency Fund Savings Tracker PDF

Everyone should have an emergency fund. (And, if you don’t, then this should be the first savings tracker template you use!).

Emergency funds are not fun funds – and they should never be used as such. They are created in order to protect you when you are, in fact, in a dire money situation.

The general rule of thumb is that you should have 3 to 6 months of your basic living expenses saved in an emergency fund. That said, if you currently have no emergency funds saved at all, get started by saving $1000…and use an encouraging emergency fund printable to help!

Travel Fund Fun Savings Tracker

While creating emergency funds is a necessary and sometimes daunting task, vacation funds are a lot more fun and exciting goals to save for!

Do you know how much more relaxing a vacation is when you have already paid for it up front? Rather than worrying about how you are going to pay off your trip when you get home, you can sit back, relax and enjoy your travels!

Therefore, using a vacation savings tracker for your fun funds is ideal! The festive vacation fund tracker worksheets are almost certain to keep you motivated toward your goal.

Can I Make My Own Money Saving Chart?

Yes, you can absolutely make your own saving tracker charts! If you are a whiz on the computer or a talented artist, go ahead and design a saving tracker chart that will help encourage you to meet your precise goal.

However, if you are short on time and want to get started with your savings right away, you can use one of the visual savings trackers that I have already created.

My downloadable saving challenge printable bundle includes the four types of savings trackers that we just discussed. You can also grab your free savings tracker printable at the end of the article!

How Do You Use a Money Goal Tracker?

Using a savings goal tracker printable form is an easy and fun way for how to track savings!

How to exactly use your printable money tracker will depend on you which one you choose to use. Personalized savings charts require a little bit of math – but I’ll give you a general idea of how to fill them out.

How a Savings Tracking System Works

The first step in how to track your money is to identify your goal and the specific amount of money it will take to reach that goal.

Next, select or create a savings tracker chart that aligns with your goal. If the chart you select already has a pre-set monetary denomination, you can print as many as you need to reach your goal – or, if the amount is over your goal, you get to select a few freebie spaces and color in the boxes until the remainder represents the amount you need to save.

On the other hand, if the worksheet is customizable, grab a calculator to do the math. Enter the total amount you need to save and divide that amount by the number of fillable sections. That number represents each section. You will need to save that much before you can color in the section.

Finally, as you start saving money for your goal, color in the squares on the visual savings tracker printable that represent the amount you have saved. You can keep it basic and just use a pen or pencil to fill in each space – or you can use fun colored pencils or markers to create a colorful worksheet.

Once the entire visual money tracker chart is colored in, you have reached your goal!

Where To Keep Savings Goal Tracker?

The best thing about a printable savings goal tracker is that you can keep it anywhere!

I think it is best to keep your savings goal trackers somewhere that is highly visible; a place where you will see it often and stay motivated toward your goal.

Some of the best places to keep your savings goal chart are on the fridge, taped to a mirror or in your top desk drawer at work.

Keep in mind, your money saving tracker printable is just a visual representation of the money you are saving for your goal. The hard part is actually saving the money.

Fear not, I have a few tips that will help you get started saving and well on your way to attaining your goal!

How To Budget for Your Savings?

If you want to save money for a goal, then you already know the advantages of savings…but where does the money come from? You will either need to find a way to make more money or learn how to better spend the money you are already earning.

Make a Budget

Trying to save money without creating a budget is like trying to take a road trip without a map. While you might get to where you want to go, you’ll likely make a few wrong turns, get turned around and you might miss your destination altogether.

Instead, start off with a solid plan: a Personal Budget.

Yeah, I know, making a budget can be intimidating – especially if you have never made one before and are unsure where to start. No need to fret. Creating a budget really isn’t as difficult as most people think.

You can start with my tips on How to Save Money and How to Make a Budget. I lay out the basics of making a budget in just 3 simple steps. All you need to create a budget is a piece of paper, a pencil and general knowledge of your monthly expenses.

If you want something a little more formal, you can use my free printable budget template.

With a budget in place, it is easier to see what you earn, how much you spend and were you can cut.

What Money Will Fund Your Savings Fund?

Hopefully, your budget revealed a few places where you can make cuts in your spending so that you can start saving – and coloring in your saving goals tracker!

Sometimes, even with a budget, finding extra money isn’t that easy. If you are struggling to come up ways to squeeze more money out of your paycheck to put toward your savings goal, I have a few tips.

Complete a Spend Analysis

Before you start using your Finance Goal tracker to save money, you should have a clear picture of where you spend your money.

While savings tracking is a fun way to watch your money grow, tracking spending will show you where you spend – and the information it reveals can be enlightening!

Find Free Things To Do

Entertainment is expensive – but it doesn’t have to be! One of the easiest places to make cuts in your budget so you can start saving money is with your entertainment expenditures.

Watch a movie at home instead of in the theater. Have friends over for a potluck dinner instead of going out to eat. Skip the concert and go to open mic night instead.

There are heaps of ways to save money on entertainment! For inspiration, use my article on the Best Free Activities.

Curb Your Appetite to Spend

We spend money for many different reasons – and sometimes we don’t even know just how much money we are spending.

If you spend absent-mindedly or are constantly rationalizing unnecessary purchases, you are not saving as much money – and filling in your savings tracker – like you could be!

Learn how to stop spending money so that you can start to get ahead.

Get Extreme

If your goal is something that you really, really, really want and you can’t find ordinary ways to cut expenses, then consider getting extreme.

Extreme frugality can help you save every last penny in order to reach your goal.

Challenges to Help You Save

Saving money is not easy – and it can be boring. However, by challenging yourself, it can be a lot less dull and even exciting.

There are all kinds of fun savings games that test your saving savviness and help push you to save even more.

Saving five-dollar bills and coin jars have been used for decades as a means to save a few bucks. But, if you are saving for something big, then you might need a little more umph with a big money saving challenge.

Cutting back on your expenses with a budget food challenge is a fantastic way to kick start your savings. In fact, being frugal with food is one of the easiest ways to quickly save money.

Where To Save Your Savings?

Your money goals tracker is a fabulous visual, but where do you stash your cash?

You might think that saving the money in an existing account will be fine, but I would caution you against it. Comingling the funds causes murkiness – plus, it is too easy to use your saved funds for something other than what you intended.

The additional savings should be kept separately.

If the amount you are aiming to save is relatively small – less than $200 – then keeping the extra cash at home in a jar or a money envelope will likely suffice. In fact, if it is an ongoing monthly sinking fund that you will save for and deplete repeatedly (like a monthly entertainment fund or eating out fund), then a fun savings fund picture box might be a fun idea.

Savings Account

However, if the sum of cash you intend to save is larger than $200, you should consider opening a specific savings account for your money.

Personally, I like to save my sinking funds in a new savings account that I can connect to my main bank account. When I sync bank accounts, it is easy for me to transfer and deposit funds into it.

Connecting the bank accounts, however, might not be the best situation for everyone. As easy as it is to deposit money into the account, it is just as easy to direct the funds back into the main account. If the temptation is too enticing for you, open an account that stands alone – even if it requires a separate trip to the bank to make the deposits (or perhaps more importantly, withdrawals).

Pro Tip: While savings trackers are excellent at keeping you motivated, remember to reward yourself along the way; this is especially important if you are dedicated to reaching a monstrous goal. When you reach a milestone savings achievement – like the halfway point to your goal or for every $100 you save – treat yourself…just do it with a cheap reward!

More Saving Tracker Methods

I love printable saving trackers; it’s something tangible in my hands that shows my funds’ growth. I find pleasure in filling in the boxes and love keeping the worksheet on display where I can keep my goals in clear sight.

But, we are not all alike – and there are other methods you can use to track savings goals.

Money Saving Tracker Apps

If you are someone who thinks paper and pencils are a thing of the past, then a digital app might be a good way for you to track your savings funds.

Apps can be good tools for tracking savings – just make sure you find one that is right for you.

The iMoney Lover app is a good free app for sinking funds and it is fun to use.

As a side note, when trying to save money, I would steer clear of the apps that are designed to subconsciously get you to spend more money. The apps that round up the cost of each transaction to the next dollar figure and deposit that amount into a separate account really just get you to spend more because you literally have to spend money in order to save it.

Money Savings Tracker Bullet Journal

A bullet journal savings tracker is a creative and personal way to track your funds and is a good tool overall for money management, if it fits your style.

If you have not heard of bullet journals, they are like a scrapbook-diary-planner all in one. Bullet journals are great for budgeting, savings, paying off debt and organizing your finances.

You can include a saving tracker section in an existing journal – or start fresh with a journal geared specifically toward money and your goals. If you haven’t used a bullet journal before, you can get started with this bullet journal starter kit.

Pro Tip: Trying to pay off credit card debt? If you have a goal of being debt free – which is an absolutely fabulous goal – you can get started with my fun Debt Trackers!

Sinking Funds Tracker FREE Printable

When you are ready to get started with your savings – and there is no better time than now! – you can download my FREE Printable Savings Goal Chart.

I designed this FREE Printable Sinking Funds tracker so that you can use it for anything you want.

Getting married? Start your Wedding Fund! Buying a house? Save for your Down Payment! Heading off to college? Get started on your College Fund!

Whatever you are aiming for, this Free Printable Savings Goal Tracker can help you achieve it!

GET YOUR SAVINGS TRACKER FREE PRINTABLE HERE!

We Want To Know: How are you tracking savings? What is your favorite kind of Savings Tracker? Give us your best tips and advice in the comments below!

Interested in more of my Budget and Goal Tips? I round them all up on the Budget & Goals page!