Some of the links on this site are Affiliate Links and if you use them to make a purchase, we may earn a commission. For more information, read our Disclosure Policy.

Budget printables are a fantastic way to take control of your finances. Using a printable budget worksheet, you can develop a budget, analyze earnings and track spending. An at-a-glance monthly fillable form is ideal for anyone who has financial goals.

You can get my FREE printable budget template here – but be sure to read on for tips on how best to use the worksheet.

How To Use a Printable Budget Worksheet

One of the main reasons we need printable household budget forms is to better dictate where we spend our money. Although we tend to think we know exactly how much we spend and where we spend it, we rarely do if we are not paying attention – and this is where a simple budget template can really help.

Of course, simply having a printable monthly budget template is only the first step to creating your budget. You actually need to put in a little work to make the free printable monthly budget template work for you. How can you stay on budget with your groceries if you don’t know how much you are spending at the store each month?

You can learn more about why completing budget planner worksheets is useful in my article, How To Create a Monthly Budget.

Put Your Budget Template Printable To Use

Unfortunately, budgets don’t magically make themselves. It takes a good amount of time and a heaping dose of effort to create a realistic budget that will help you meet your money goals. Most importantly, you need to be honest – with yourself and your finances – when completing your budget spreadsheet. You are only cheating your chances of succeeding and attaining your goal if you don’t face your budget with an honest approach.

As you sit down to complete your printable household budget worksheet, remember that it is just piece of paper if you don’t take the time and put in the effort to honestly complete it.

Read about how I changed my Relationship with Money – and How You Can, Too!

What You Will Need To Complete Your Budget Organizer Printable

Regardless of whether you obtain free budget printables or purchase complete kits, there are a few things you will need to complete your monthly forms. You may already have these items around the house, so use what you already have before buying anything new!

Printer

My free printable monthly budget is designed to be printed and completed with a writing utensil. In order to print it, you will need access to a printer. If you do not have a printer at home, check the cost of printing at your local library before heading to an office store.

By the way, my budget planner template printable is designed in color, but you don’t need to print it in color (as color ink is more expensive). Instead, opt to print the free printable financial planner in black and white.

Writing Utensil

When I first started using a financial planner printable, I used a pencil…with an eraser. In my first attempts at tracking my budget, I made mistakes, found errors and made omissions that I had to keep going back to correct. Now, as I am more confident in completing my personal budget template printable, I use a pen – but if you are just starting out, I 100% recommend using a pencil!

Calculator

Even when using a simple budget worksheet printable, it is a good idea to have a calculator at hand to do basic addition and subtraction. You likely have one on your smartphone that will do the job.

Binder

I highly recommend keeping your completed free printable budget worksheets month after month in a binder. Past data is an excellent reference point, as well as useful in continual motivation toward your ultimate goal.

Check to see if you have an old binder at your house that can be repurposed as your printable household budget binder. If you don’t have a binder, a basic folder will work for now. Additionally, if you are more tech-minded, you could scan your completed monthly budget forms printable to your computer.

Just remember, if you are using a 3-ring binder to store your printable budget templates, you will need a 3-hole punch, as well!

How To Complete a Budget Template Printable

Completing my free printable personal budget template is not really complicated, but it does require some math and a little research. Set aside about an hour to complete the free printable monthly budget planner.

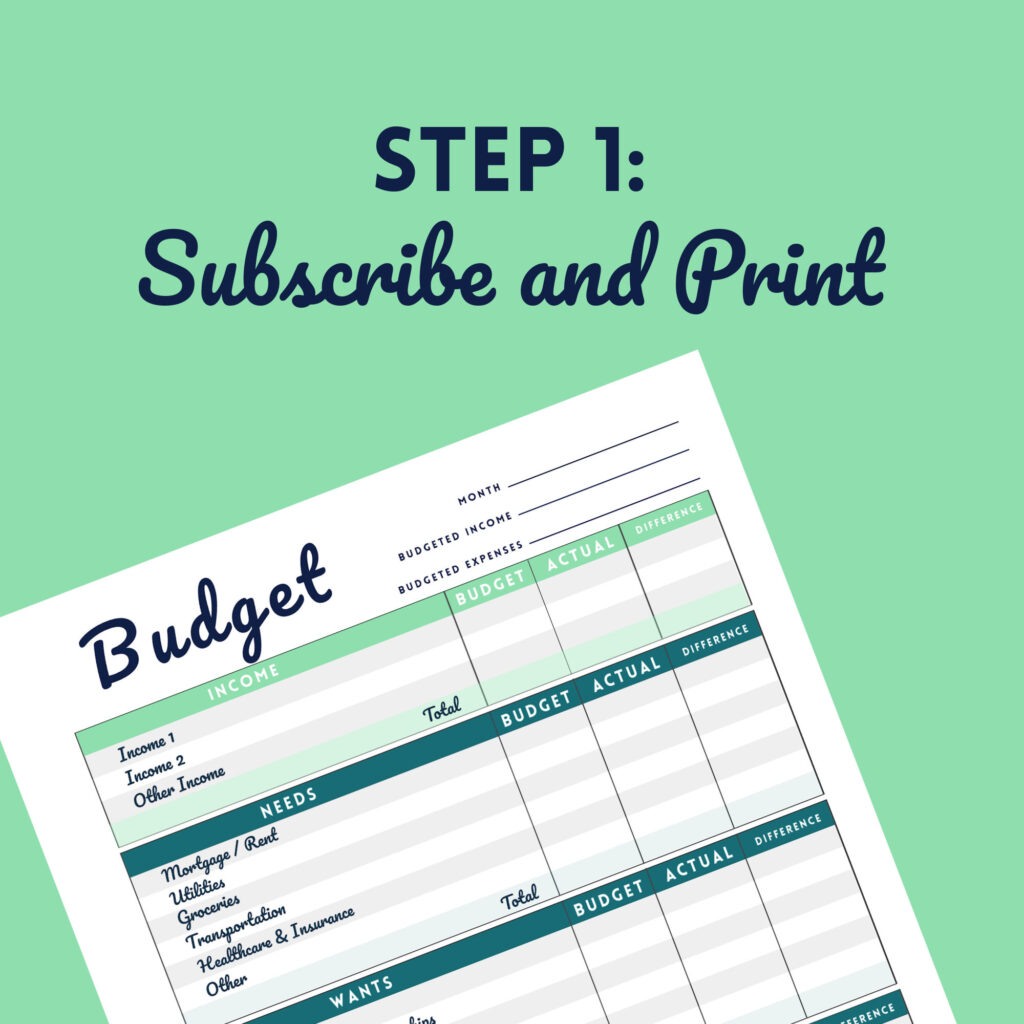

Step 1: Print the Monthly Budget Worksheet Printable

As I already mentioned, my home budget template printable is free and you can get it here. It is designed to be printed and then completed – so, naturally, you will need to print the form. My free budget worksheet is a PDF format that is ready to print – just remember to select black-and-white if you don’t want to use color ink for your monthly budget templates.

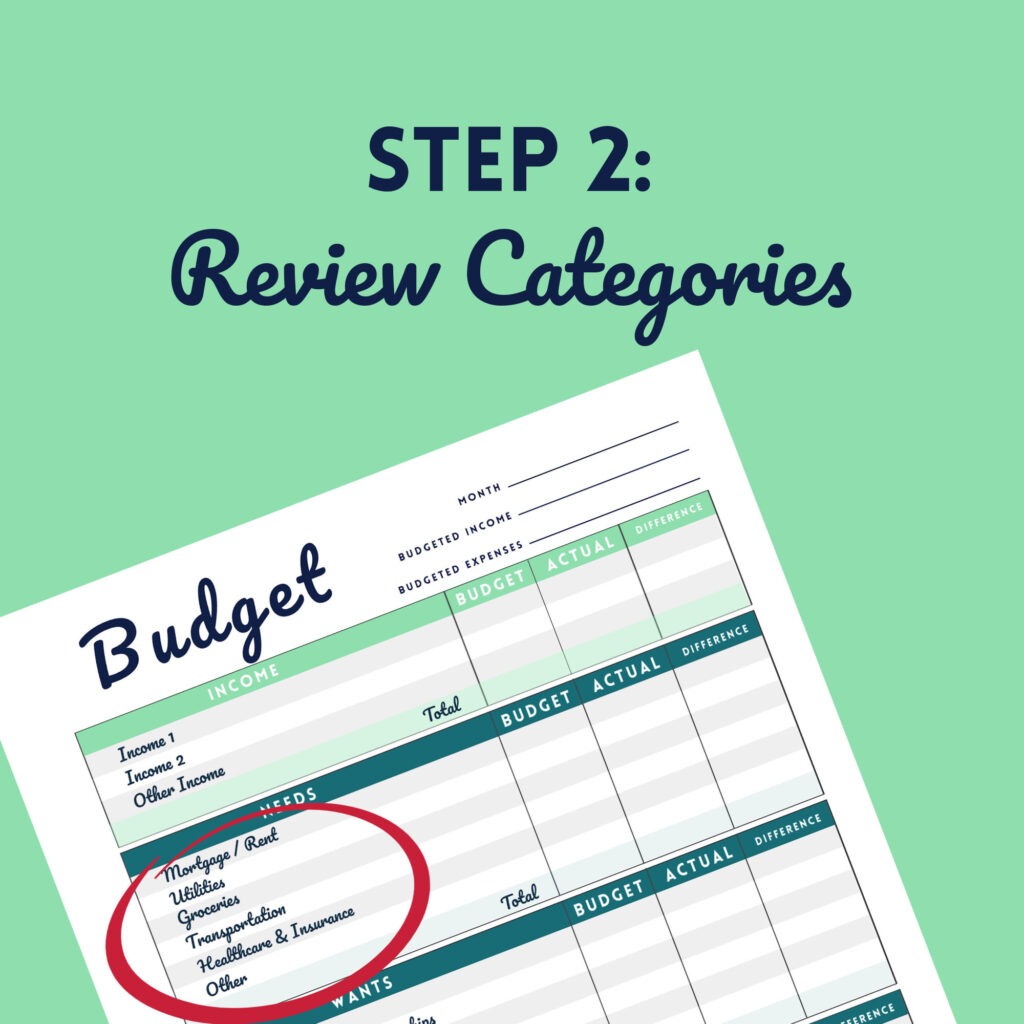

Step 2: Review the Categories on the Printable Monthly Budget Planner

My printable home budget worksheet breaks down spending into three budget categories: Needs, Wants and Savings/Debt Repayment. For each category, I have included sub-categories of common expenses. Review the categories on my free budget planner worksheet printable to begin to jog your memory of where you commonly spend your money.

If one of the categories isn’t applicable to your budget, cross it off and use the space for something else (like a sinking fund) – and use the Other line item as a catch-all for any additional expenditures.

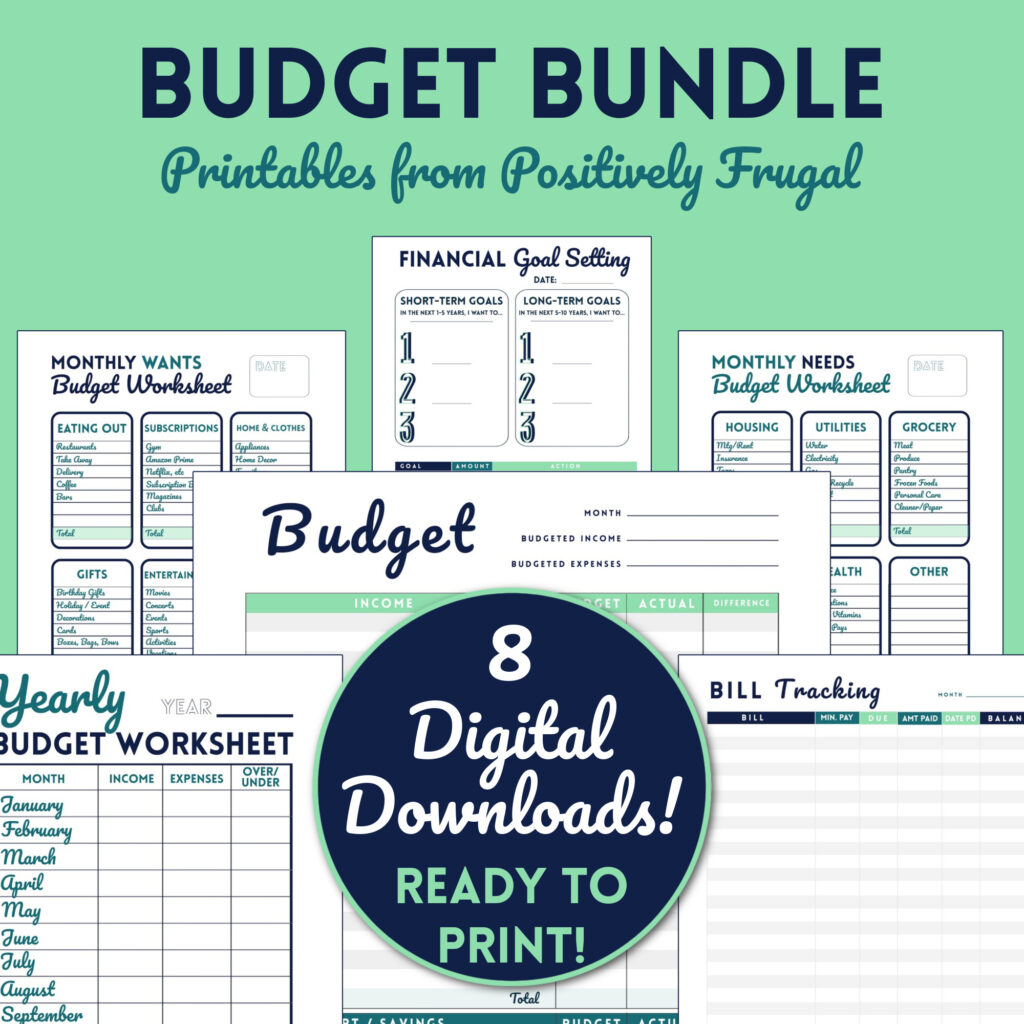

Pro Tip: The free printable budget sheet comes with categories already in place. However, if you want a blank budget worksheet printable, I include it as part of my Complete Budget Kit and my smaller Budget Bundle.

Step 3: Gather Information on Your Expenditures

Before you complete your printable monthly budget planner template, you will need a crystal-clear picture of how much money you make, where you spend and how you save. Don’t make guesstimates; get actual figures. Your simple monthly budget will be useless if you are not using factual amounts.

Income Figures for your Free Budget Worksheet

First calculate your income. It will be easy if you are a salaried employee, but hourly wages and self-employment paychecks require a little more thought. I recommend using an average of several previous months, rather than simply looking at the last month’s income. The figure to use is your take-home pay, after taxes and other paycheck deductions.

Additionally, if creating a family budget planner, make sure you include all income of contributing parties.

Calculating Expenses on your Free Budget Planner Template

The best way to ensure you calculate your expenses accurately is to look at past credit card statement, bank statements and other bills. Gather as much information as you can about your expenditures.

If you use cash, it can be a bit more difficult to track your money – especially if you don’t keep receipts. In this case, for your first budget, you will have to make some guesses as to how much you spend with cash. For future monthly budgets, however, I recommend that you start tracking your expenses – all of your expenses – starting now.

Calculate the amount spent for each of the Printable Budget Forms’ Categories and notate it either on the form (there is plenty of room on each line) or on a separate piece of paper. I include Needs and Want forms and an expense tracker in my Complete Budget Kit that are useful, too.

These calculations will help give you a starting point – and idea of where you can cut and where you can save money in the future.

Step 4: Make a Realistic Budget

To complete a realistic budget, you need to base your budgeted figures on your goals, past expenses and anticipated income. The budget limits that you set must be realistic. For a Zero Based Budget – which is the style of my free budget template – your income needs to be equal to or greater than your needs, wants and savings/debt repayment combined. If it is not, you need to rework the numbers.

It may help to jump around on the worksheet a little bit here. You may want to enter your anticipated income first, then your savings or debt repayment goal. Once you have those numbers, calculate your needs next. Finally, use whatever you have leftover for the wants category.

Using the established categories in my budget planner worksheet printable, enter your final realistic figures under the Budget column – and total up the amounts.

Step 5: Stick to It

You have completed the basic steps in creating a budget by filling out the budget portion of your personal budget worksheet printable – but now it is time to really do some heavy lifting…as in, make changes to your spending habits in order to ensure that you hit your target numbers.

The basic budget worksheet printable is just a guide – a map – to your budget goals. In order to attain those goals, you need to keep track of your spending and stay on top of your budget (I include forms for tracking in my Budget Bundle). No one else can do this for you; it is completely up to you to control your spending and limit your funds to the amount you dictated in the budget column.

That said, I do have a few tips for sticking to your budget in my blog post, Money Goals.

Step 6: Add the Actual Figures to the Budget Tracker Printable to Calculate Your Final Figure

At the end of the month, you need to calculate your actual costs to see where you came in under budget, where you were right on target and any places you may have exceeded your budgeted amounts.

Enter all of the actual amounts into the free printable home budget worksheet under the Actual column. Subtract that amount from the budgeted figure – and enter that dollar amount into the Difference column.

Using the totals from each category, subtract Needs, Wants and Debt Repayment/Savings from your total income at the bottom of the worksheet.

Now, looking at your completed monthly budget printable, analyze the data. How did you do? Are there any surprises? Do you feel successful or disappointed? Do you see where you can make changes?

Step 7: Repeat the Process with a Fresh Printable Budget Planner

Taking what you learned from the first month, repeat the entire process for the next month with a new printable monthly budget template. (You can use the link I send you to print as many free budget templates as you need, so save the email!)

Using your goals and Actual figures from the first month, fine tune any of your budgeted amounts to make them more realistic. Then, at the end of the month, see where you are!

I highly recommend completing this monthly process indefinitely. As you change, grow and learn how to be more frugal, your printable budget sheets will continue to help you get to your goal.

Get Organized

Learning how to create a budget is just one step in the process of organizing your finances.

Staying organized with your money – both your budget and your expenses – is the key to success. To help, I share more of my top tips in this dedicated article for organizing finances!

If you are sorting out your money matters for your family, then start by reading my blog post on Family Finances. The tips I share will help ensure you track your savings and meet your goals!

Printable Budget Planner Kit

Hopefully, you have already downloaded my free printable budget planner. It is the best place to start when you are making your first budget.

Additionally, I offer complete kit of affordable budget printables that includes more detailed worksheets. Each one of my printable budget sheets are designed to help you reach your monetary goal. There are 18 budget printables included in my Complete Budget Planner Kit – which you can check out here or you can find all of my printables on my Shop blog page.

Review of How To Use my Free Monthly Budget Worksheet

- Download and Print the Monthly Budget Template Printable

- Review the Categories on the Budget Planner Printable and Make Adjustments

- Collect Essential Income and Expenses Information

- Dictate How Much To Spend in Each Category of Free Printable Budget Worksheet Template

- Adjust Your Spending Habits and Stick To It

- Calculate Your Monthly Figures on the Free Budget Worksheet Printable

- Repeat the Process with a New Printable Monthly Budget Tracker for the next month

Interested in more of my Budget and Goal Tips? I round them all up on the Budget & Goals page!

Pin It!